I spend a good part of each day pouring over details of recent records of trades from corporate insiders.

But even I found today’s delve to be a bit “eyebrow arching”.

The CEO of Hub Group (HUBG) went out and bought nearly $5MM of stock.

That’s quite a bet!

If you’ve ever played poker, you’re probably familiar with the term “feeler bet”.

It’s a wager you’d make just to test how committed your opponent is to their hand.

The key to a good “feeler bet” is to make it big enough to see if your opponent is really committed to their hand…

… but not so big that it costs you a big chunk of your stack.

Pay a minimal cost for valuable information.

This same concept can save you from a life of heartache and pain in the markets…

Because if you dug into the nuance of this filing, you’d see this:

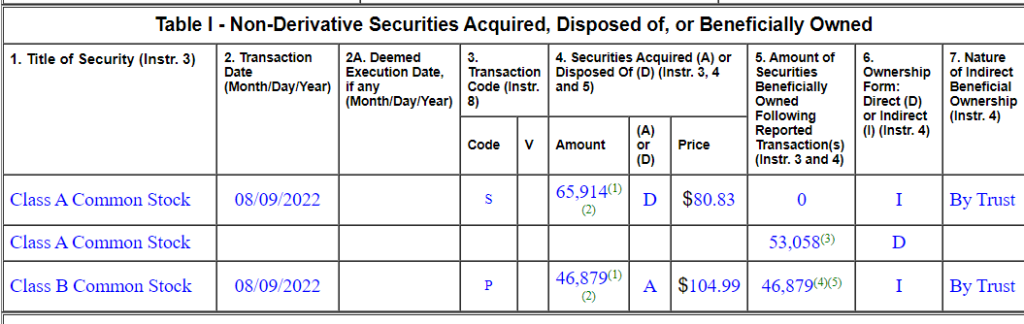

What you’re looking at is a screenshot of the Form 4.

It turns out, this isn’t a huge insider bet at all, it’s a conversion of stock classes.

And just to ice this moldy cake, it’s going into a trust, so it’s not a huge buy at all.

Now, to be fair, it doesn’t mean that HUBG might not be a good bet…

But it’s not a good bet just based on this transaction.

If you know how to throw out “feeler bets” for these kinds of insider moves…

You can see how strong the insider’s hand really is.

Are they faking you out with a bluff? Did they make their flush on the turn?

I’m sure you get where I’m going with all of this… being able to dig deeper and gain more nuance…

Saves you from the palm-to-your-forehead humiliation of being the trader who chases based on this headline:

The old cliche -- “if you’re in the game for 10 minutes and don’t know who the sucker is… you’re the sucker” could not be more apt here.

You need to really “read your opponent” deeply.

Right now, the best read on the markets tells us that we need to find pre-catalyst stocks with real insider commitment.

But you’re not going to find them by pursuing eye-grabbers on FinTwit…

Or spending 10 minutes perusing a scanner…

You need a real system to zero in on these plays, “feel them out,” and pull the trigger when the odds are loaded in your favor.

If you want to know how to do this:

>>> Watch This To See All Of My Setups

Original Post Can be Found Here