Yeah, it was pretty bad.

Again.

The CPI came in hot, above expectations, leading to a small selloff.

But it wasn’t anything like last month, because those who needed to deleverage already took their positions down.

On top of that, we now have a Fed that is super clear that they’ll hike aggressively.

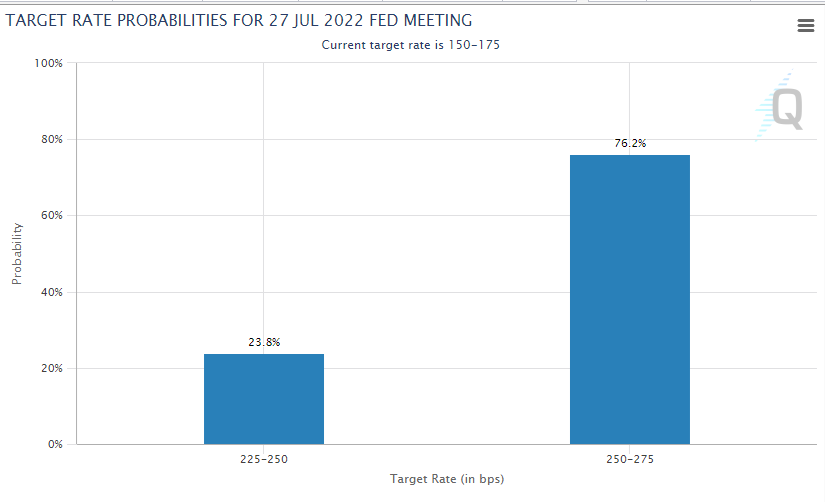

Here are the current odds of what the Fed will do during the July meeting, per the Fed Fund Futures market:

A month ago, the market priced in a 50% chance of a 2.00 - 2.25% rate.

Today, there’s now a 78% chance of a 2.50-2.75% hike.

I’m becoming more contrarian on this issue…

I think deflation is setting up to be a bigger risk than inflation. More on that in a few days.

But the volatility in bonds and stocks has helped us find some nice deals.

For example:

We discovered an eCommerce company trading at a 1x sales multiple, and it’s setting up for a quick potential 50% pop.

And, just today, we rolled up on a former high-flyer stock — a key insider threw down a ton of cash into the company.

If it hits my key levels, we could be good for 50% gain here…

And if our options play works out, we’ve got at least 160% potential return on capital lined up…

And that’s just the start if this gets going.

As I’ve said recently, we’re seeing some former high-flying tech and biotech names pivot.

This isn’t me being a genius stock picker, believe it or not.

I’m just following investors MUCH smarter than me.

They’re among the smartest investors on the planet… because they’re the company insiders.

Go here to learn how you can start following the insiders today.

Original Post Can be Found Here