Recently, I shared with you a long-term bottoming indicator in the markets…

And how we can break it out by sector.

Right now, healthcare is looking pretty hot:

Quick summary: This is the buy/sell ratio, and it measures the amount of insider buying happening across the market or within sectors.

As you can see:

A ton of insiders are parking serious cash into their companies.

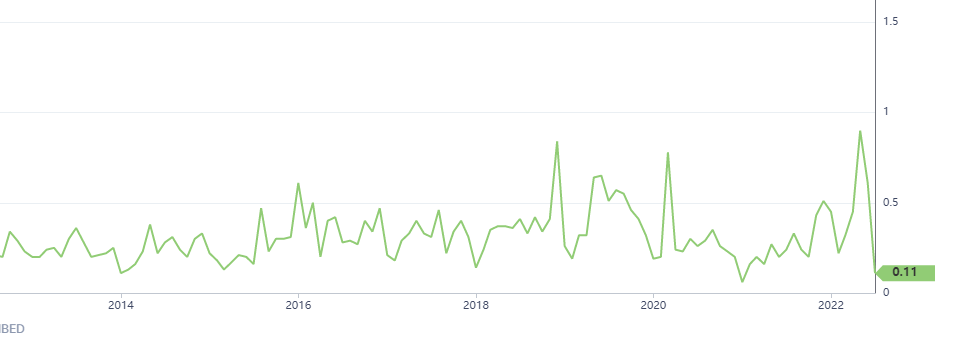

Given the year biotech’s had, it’s worth a look:

That’s a 60% drawdown from high to low.

Odds are, there are some deals in there.

That’s why we’re playing a small biotech stock down over 90% from its highs.

But what made us pick one specific company over another?

Do we have some special knowledge about the company?

No… but I think I know who does.

Take a look at this chart:

That first arrow is where this company’s CFO — the person who knows all the financials — dumped around half a million $$$ in shares.

Right near the top of the market. Not bad.

And now, they’re buying back in FAR lower than where they sold.

As the legendary Peter Lynch said:

"Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

If you want to learn how we find companies like these and how to grab this ticker for yourself…

Go watch this insider trading presentation.

Original Post Can be Found Here