At Insiders Exposed, we’re always hunting for opportunities signaled by the smartest investors in the room:

They have deep company knowledge the world’s best analysts would kill for…

And such information can lead to some juicy profits.

Today, I want to share with you a type of insider activity I call a “Blue Moon” setup.

See, it’s uncommon to see insiders at large companies make open market purchases. They only buy “once in a blue moon,” hence the name.

That’s because they’re awarded restricted stock units (RSUs)...

So they don’t really need to up their stake significantly.

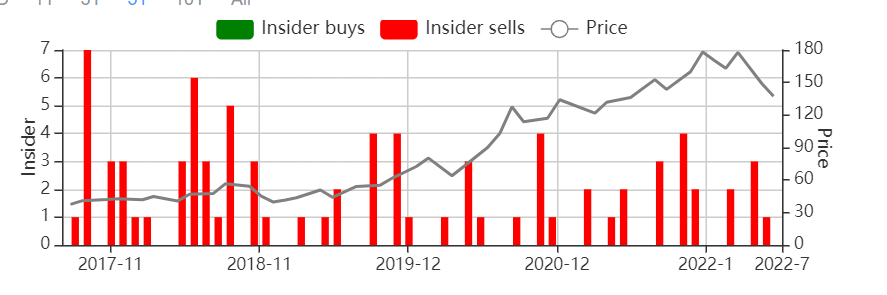

Take a look at Apple’s (AAPL) insider transactions:

Not a single buy over the past 5 years.

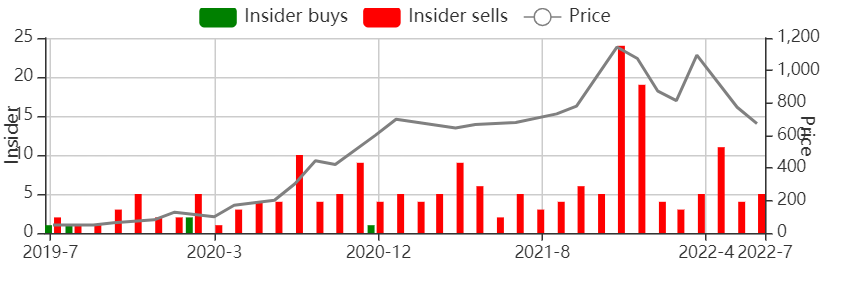

Tesla (TSLA) is a similar story:

Almost all selling…

But following those few buys sprinkled throughout could’ve offered you some nice upside movement.

Those buys generally occur when a corporate insider sees something within the company that offers upside potential… encouraging them to scoop up their stock beforehand to take advantage.

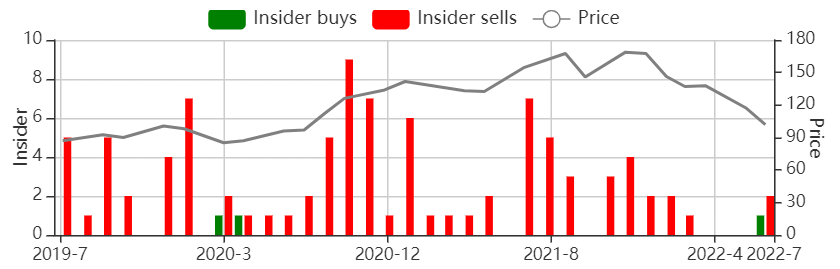

Here’s a recent example from a name-brand mega-cap:

We’ve only seen insiders buy this stock two times.

The first was the March 2020 panic low…

And the second time is now, after another market bloodbath.

When insiders buy big on dips, especially when they rarely buy at all…

That’s a strong sign of potential upside.

If my first targets are hit, we’re looking at a 30% potential gain on the stock…

And potentially many multiples higher on our options.

Click here to learn how you can take advantage of our legal insider trading strategy today.

Original Post Can be Found Here