The market has a nasty response to Friday’s insane CPI data:

CPI Chart

Are investors worried creeping inflation could shrink their favorite companies’ profit margins?

Or that consumer behavior will shift toward less spending?

Nope.

Those risks can matter down the road, but the immediate response all comes down to the Fed’s aggressive policy changes.

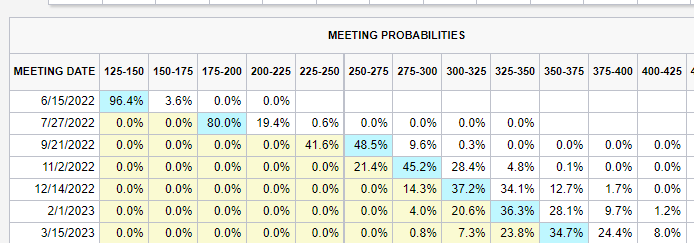

That 8.6% inflation data caused the Fed futures market to panic and start pricing in a potential 75 basis point hike on June 15th.

The wild thing here is what the market is pricing further out in time:

Meeting Probabilities Chart

The market is expecting a 3% Fed Funds rate by the end of the year.

I’m calling BS.

A 3% Federal Funds rate means you’ll see mortgages north of 7% and corporate borrowing rates at levels not seen in a while.

There’s a genuine possibility the Fed overreacts (again) and hikes too fast (again)...

Causing them to dump liquidity back into the market (again).

If only there was a way to fade these expectations!

I want to look at a trade that’s catered more towards the institutional side, but still fun to look at in this situation….

Enter Eurodollar futures.

EUR/USD Futures Chart

This chart looks like a hot mess, but that’s because there are contract rollovers that create big disparities in price.

If the market prices in 2% in July and 3% in December, each futures contract will have a price corresponding to that.

We want to look at GEZ2022 - the contract for December futures:

GEZ2022 Chart

Now we’re getting somewhere.

I don’t want to get into the weeds on this… but if you think the Fed will ease back on hike expectations through the fall, you might look to long this contract.

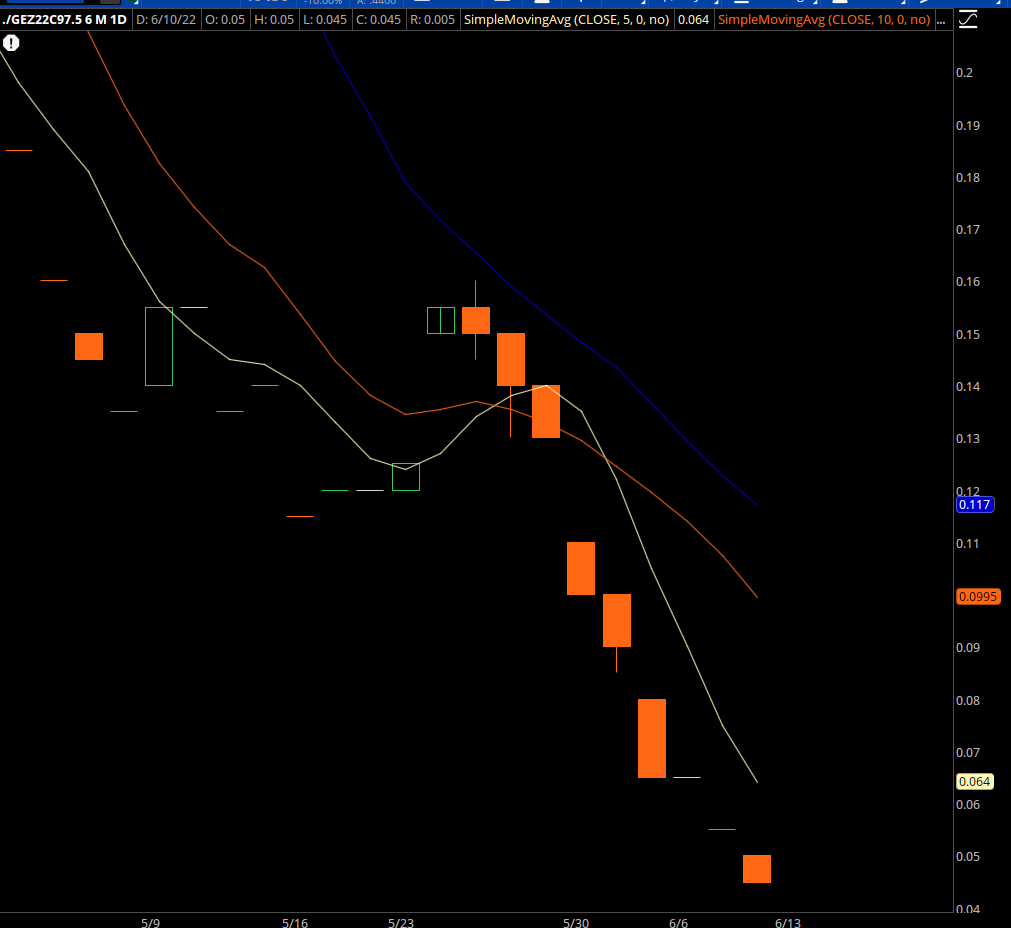

I would use options — something like the contract ./GEZ22C97.5.

GEZ22C97.5 Chart

Over the past few weeks, this option’s value dropped from 0.16 to 0.045.

Here’s the trade:

If we see signs that Fed policy is breaking things… if credit spreads start to widen or banks sell off hard, getting long in the Dec Eurodollar is a good trade because the Fed will be forced to pullback.

It’s a cheap bet that could work if we start to see risk in credit or if inflation starts to subside

Original Post Can be Found Here