The market plummeted last week as the inflation print came in hot.

That number was 8.6% year-over-year CPI, for your information.

My concern is that if commodity prices continue to stay “sticky,” these prices will continue to work through the economic system longer than we want.

Energy prices don’t seem to be improving, either.

The US’s gas price just hit a $5/gallon average, and gas futures continue to grind higher:

We can blame a good chunk of this on the lack of refining capacity in the oil markets.

If you look at the difference between crude oil and refined products, you get the “crack spread.” Here’s how it has done recently:

If we can’t refine oil, things get stuck.

Of course, building more refineries is an easy way to fix this. Or we could at least restart some of the refineries that had been recently shut down.

Simple, right?

Well, remember this: our federal government is run by a man who campaigned on shutting them down.

We went from being a net energy exporter…

To being forced to release oil from the Strategic Petroleum Reserve SPR to try and put a cap on prices.

That’s a band-aid solution, of course, given how much oil the US uses in a single day.

Now, Congress is trying to push through price controls (because that’s never been tried before), and the State Department is allowing two of the worst countries on the planet to buddy up:

Awesome. I’m sure this will help maintain stability in the Western Hemisphere.

Wait a second… I thought both of these countries were under US sanctions?

Oh.

So instead of having a sound domestic energy policy…

This administration is scrambling to make up supply on the margins by allowing terrorists to work together to ship oil to Europe at a massive price.

Hey, but at least we’re banning Russian oil!

Geopolitics aside, this has offered profit opportunities in several oil refineries — and I’ve been using my Investor Invasion system to scope them out.

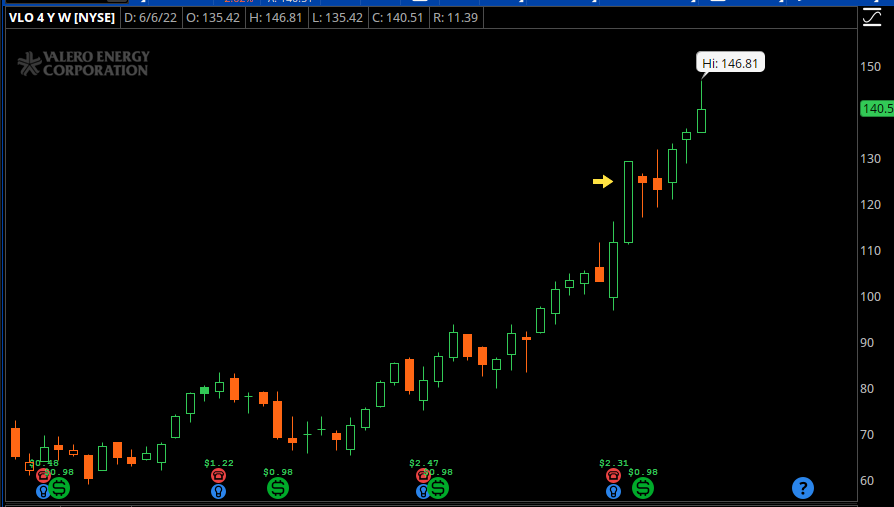

For example, here’s Valero Energy (VLO):

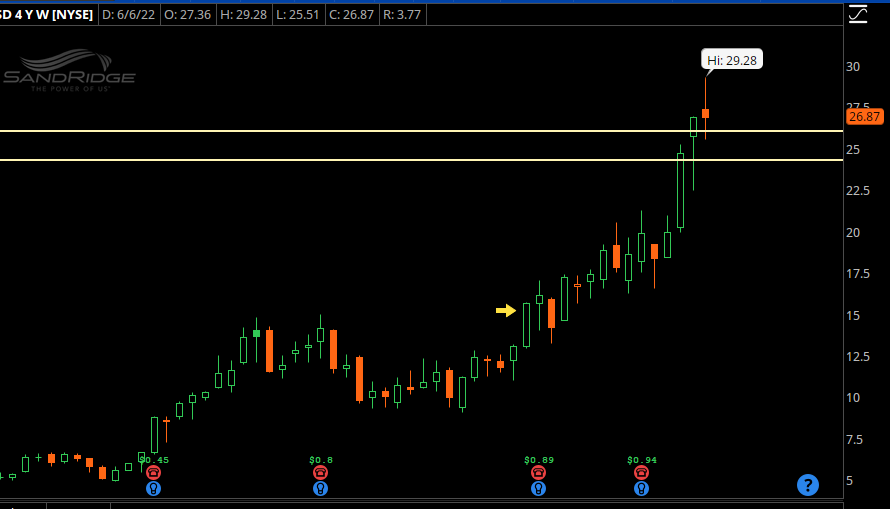

How about Sandridge:

In both images, that yellow arrow points out where the Investor Invasion system detected these opportunities (in VLO in May and Sandridge in February)...

Both times, they had nice runs — and we’re actively hunting for

Here are Insiders Exposed, we’ll also be looking for potential insider buying that alerts us to good oil opportunities.

If you want to join us, first:

Watch this webinar on our insider trading strategy.

Original Post Can be Found Here