Last week was a fun time week in the markets. We saw increased volatility in the indices, while risk assets started to see some sneaky divergences.

While The S&P and Nasdaq were making new lows on Friday, we saw a lack of selling aggression in areas like tech growth (ARKK), biotech (XBI), and cannabis stocks (MSOS).

From my perspective, this tells me that we could be seeing the end of a deleveraging cycle in risk.

The large-cap names that are getting hit have been a source of liquidity for funds, and now we are seeing forced selling in names like AAPL, TSLA, WMT, and COST.

SPY Chart

This index continues to interact with the swing Anchored Volume Weighted Average Price (AVWAP) from the March 2020 lows.

Yes — we broke it on Friday because of selling acceleration in AAPL, but a “stick save” from the Nasdaq got us above it.

If the market wants to head lower next week, our first bounce spot’s on a minor low volume node (LVN) at 377, and then all the way down at 371.

If Friday’s lows are broken, you must continue to adjust for higher volatility.

To the upside, we have the volume shelf at 398, where sellers showed up on Friday. If we test this, I wouldn’t short because it would be too early. Instead, I would look for a break of Friday’s low, selling acceleration, and then a test of that level.

Remember:

Bear market rallies are the strongest rallies the market can provide.

A much more quality level will be on the test of 405.66, all the way up to 410. If there are trapped longs looking to liquidate, we’ve got some good places to expect them to show up.

I received a DM from one of my friends about Friday’s price action:

DM About QQQ Chart

Here’s where that level hit:

QQQ Chart Close up

That level goes all the way back to the December 2018 crash lows:

QQQ Chart from 2018

The fact we had a massive response there tells me this is a valid level to interact with. It’s probably a place for short covering and a little buying on the institutional side of things.

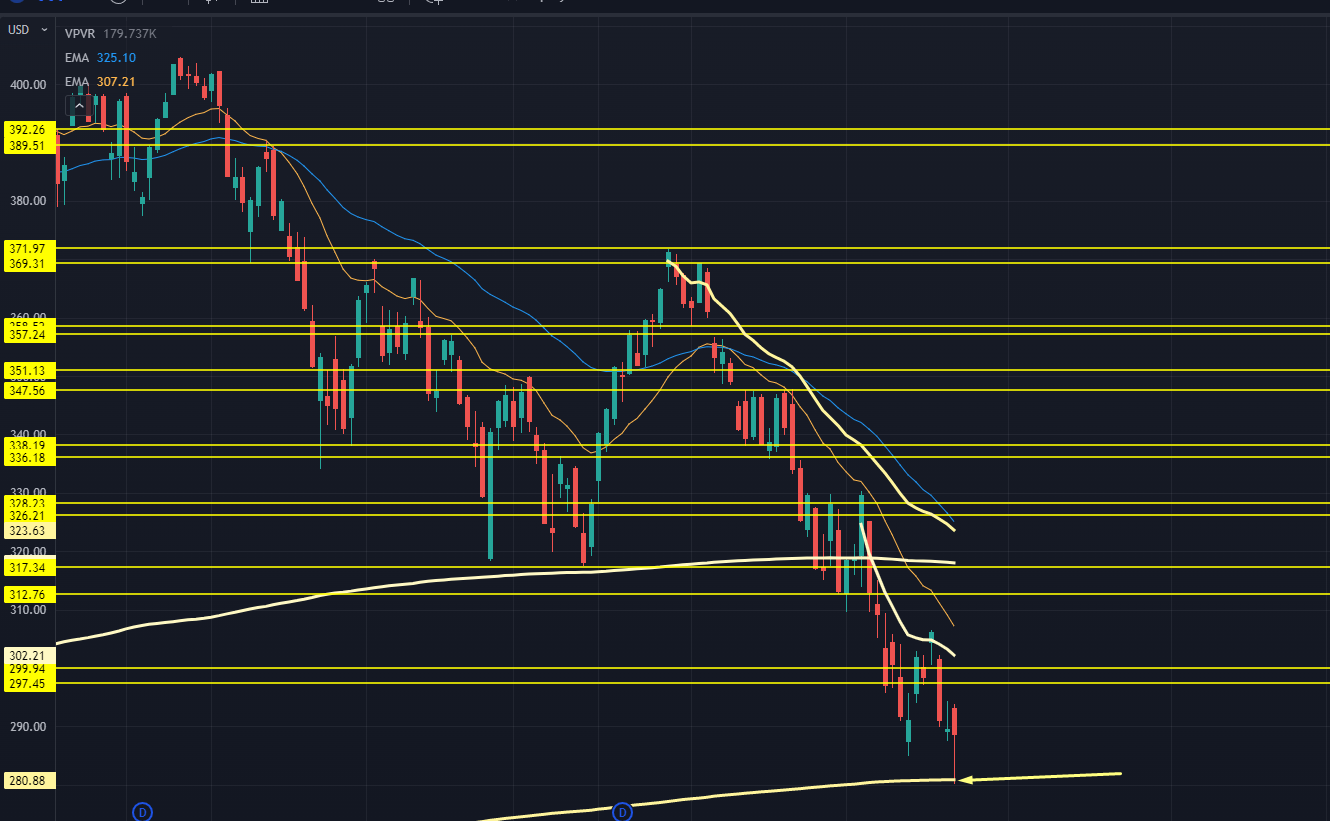

Here are is the Trading Roadmap for QQQ:

QQQ Chart

To the downside, we have our first zone at 274-275. That’s the next LVN and a gap fill from Fall 2020.

Below that we have a VERY WIDE zone at 261-267. You can split that up into two different areas, but if we hit that level this week, expect volatility to be cranked and to potentially see 3-5 point swings.

Size your position accordingly.

On the upside, we have our first resistance at 297-300, aligning with prior support from March 2021 and the swing AVWAP from the most recent pivot highs.

Above that, we have a ton of volume traded at 312-317. I wouldn’t be surprised if we start to see some profit-taking and more liquidations into that level.

On the flip side: Again, remember that bear market rallies can be massive.

If we see the same kind of rally as we did in March, you’re looking at a push into the 330s.

IWM Chart

This is a massive divergence against the large-cap indices. The Russell made a higher low and simply filled the gap before bouncing. It’s still interacting with a MASSIVE level that goes back to the February 2020 resistance.

I’ve zoomed this in so you can see the levels better:

IWM Chart Close up

To the downside, we have 166-164, and then 160-158. Both of these levels are key LVNs and internal pivot levels from the past few years’ trade.

To the upside, we have the swing AVWAP from April and the 20EMA. It’s seen key price interactions on major support and resistance from the past month.

Above that, we have prior swing lows at 188 which will line up with the swing AVWAP from March and the 50EMA. I wouldn’t be surprised of liquidations into that… odds are that level will hit when QQQ hits its liquidation level.

I’m still completely thrown off by how the volatility markets are trading. The market is running above 35% realized vol, and spot VIX is trading at 30.

Either the vol market is going to look very smart… or very stupid.

I do have one theory on this, and it’s tough to prove.

We’ve recently seen that options flows continue to influence price movement in the markets.

I covered this topic last week at Benzinga’s Fintwit conference in Las Vegas, and you can watch that here:

We didn’t see selling accelerate in the broken “high risk” stocks, so it’s possible that options flow drove the most recent selling as we moved toward May options expiration.

Now that a lot of that options exposure is off the books, we could end up with a “liquidity pocket” on the sell side, causing a strong rally.

Remember: lack of liquidity in the market runs both ways.

Anyways, that’s all for this week’s Market Primer.

Watch this free webinar for more information on our Market Roadmap.

Original Post Can be Found Here