Twitter (NYSE:TWTR) is the iconic social network behemoth that amassed 217 million monetizable daily active users (mDAU) by the end of fiscal year 2021. The company — founded by Jack Dorsey in 2006 — is widely considered as an influential platform where people come together to exchange and share ideas. And TWTR stock has a much better chance to flourish under pending new owner Elon Musk, compared to previous politicized owners and board of directors.

Twitter has been heavily trending in mainstream news and social media recently. On April 25, Twitter’s board of directors accepted the $44 billion hostile takeover bid from Elon Musk. It is now awaiting approvals from regulators.

Should the deal come to fruition, it will be one of the largest buyouts in the last decade. The stock is trading above $50, showing increasing expectations that this deal will be consummated.

The South-Africa-born tycoon, who is ranked as the world’s richest man, has publicly lined up his financing package for the offer to add board pressure. The package encompasses a $25.5 billion of debt led by Morgan Stanley (NYSE:MS). This includes a $12.5 billion margin loan against his Tesla shares.

It is still unclear as to where the equity part will primarily be sourced from. Strong Wall Street ownership in Twitter has added pressure to the board to sell the company, as this could be the only upside opportunity in the near-term for shareholders. According to the press release from Twitter, the company will go private.

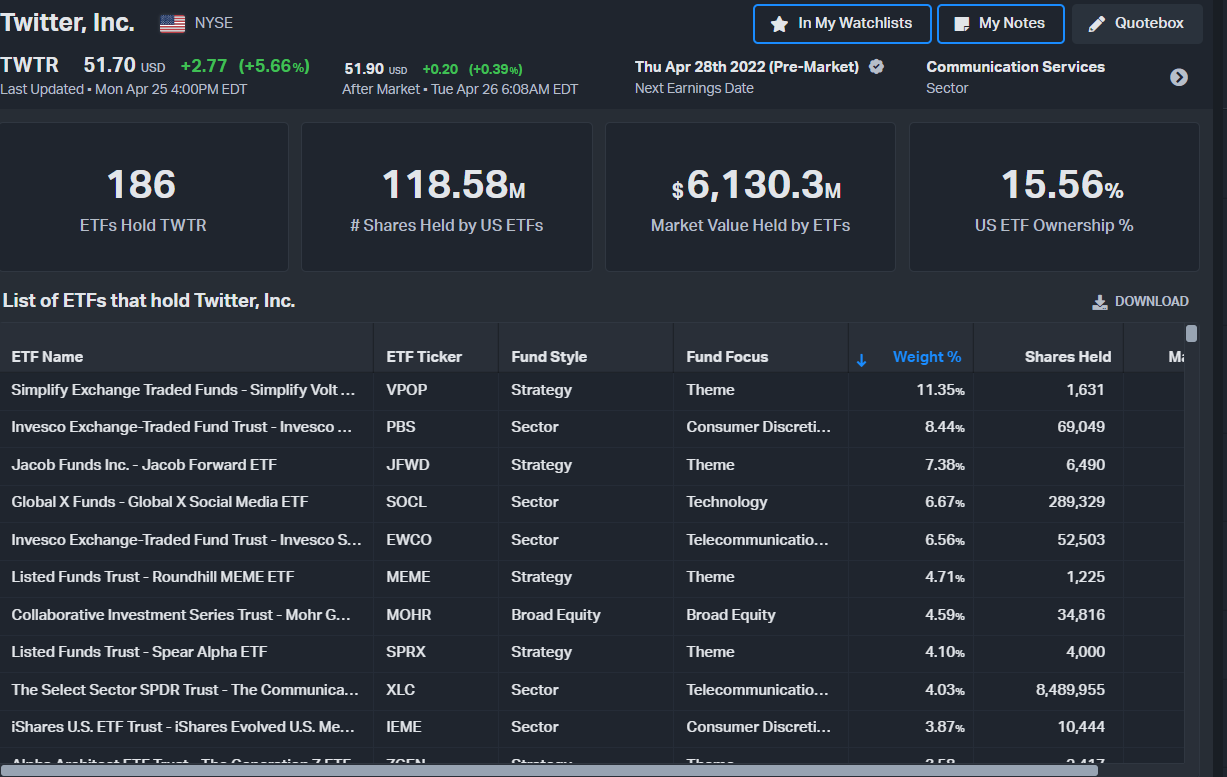

The table below shows TWTR stock ETF ownership.

In November 2013, TWTR stock had its initial public offering (IPO) at the New York Stock Exchange (NYSE), closing at $44.90 per share. Its 50-day moving average price today is $39.45. Since 2013, the company has managed to return 24.37%, displaying a weak performance compared to the overall market. During the same time period, the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) has returned a total of 136.8% and the technology driven QQQ ETF(NASDAQ:QQQ) has returned 284.4%.

Competitor Meta Platforms (NASDAQ:FB) has returned 298.8% in the same time.

Twitter’s five-year monthly beta is at 0.8 and volatility is at 50.89 compared to 15.3 for the one-year SPY ETF volatility.

In January 2021, TWTR stock marked its highest-ever market capitalization of $61.6 billion. The day prior to the Musk acquisition, Twitter’s market value was $37.2 billion. TWTR stock is lagging as a publicly listed entity and has consistently underperformed the overall market – in terms of performance as well as volatility.

Companies like Twitter, Snap (NYSE:SNAP), Alphabet’s (NASDAQ:GOOG, NASDAQ:GOOGL) YouTube and social media platforms overall use monetizable daily active users (dMAU) as a crucial performance indictor. Much of the income of these companies is generated through targeted and specialized advertising revenue.

The earnings report for Q4 2021, disclosed annual revenue growth of 37% to $5.08 billion and 13% average monetizable daily active users (mDAU) growth, to 217 million. Net income for FY 2021 was -$221 million and free cash flow (FCF) came in at -$378.9 million. The company has around $5.5 billion in debt.

Twitter’s CFO stated that the company is on target to reach 315 million dMAU by Q4 2023, as well as $.7.5 billion in annual revenue for 2023. However, this company has underdelivered to its promises before. In 2021, the company settled an $809.5 million lawsuit from an individual investor who claimed that management had mislead him to believe unrealistic growth would occur – including subscriber and revenue growth.

The new owner to be — Elon Musk — already owns and operates four successful billion- and trillion-dollar companies that he helped built. Under his leadership, Twitter might attempt to become less reliant on ad revenue, remove bots, open the algorithm and verify real humans on the platform.

A subscription model also has been in the talks. Charging for Twitter access could translate to higher revenue due to more traffic and activity that is likely to be generated from paid users. Musk’s popularity and persona has the potential to attract more volume and power users on the platform.

Now that Wall Street has been removed from the board, there will be less politics and more actual product development. This time around, the company might reach its true potential.

Elon Musk’s track record, product acumen and free speech principles are all significant bullish TWTR stock factors. I believe Twitter will increase its value, especially if the company is privatized and out of the public market pressure. Musk has climbed the highest mountain by making EV producer Tesla profitable in large scale production, an achievement considered unattainable by many – including Bill Gates.

Macro-level developments are prohibiting stocks from thriving in this economy. Yet, I classify Twitter as having a much stronger outlook now, due to the recent changes. And at $50, there’s still upside here to Musk’s $54 buyout price.

A month ago – I would have stated that Twitter is fundamentally broken and it is an unreliable long-shot investment. But now, the company has hope.

Original Post Can be Found Here