I live in Florida, not far from a U.S. Air Force test range.

That means we get every type of fighter jet you can think of flying directly over our house.

F-4 Phantoms… F-14 Tomcats… F-22 Raptors… F-35 Lightnings…

F-22 Raptor

We even see V-22 Ospreys every once in a while.

Now, I absolutely love fighter jets. I love the way they look, the way they sound, and I love imagining how much fun it must be to fly one.

… but I understand they’re big and expensive, and that the nature of war is changing.

If we’ve learned anything from the war in Ukraine, it’s that drones are completely reshaping the face of war.

According to Reuters, thousands of drones have been deployed to track enemy forces, guide artillery targets, and deliver payloads deep inside enemy lines.

The trend is clear…

The only problem is the U.S. has not yet contracted with a drone manufacturer. The leading company right now is DJI – a privately held Chinese tech firm.

What that means, though, is there’s a major market opportunity for a U.S. company.

There are a few drone plays out there right now.

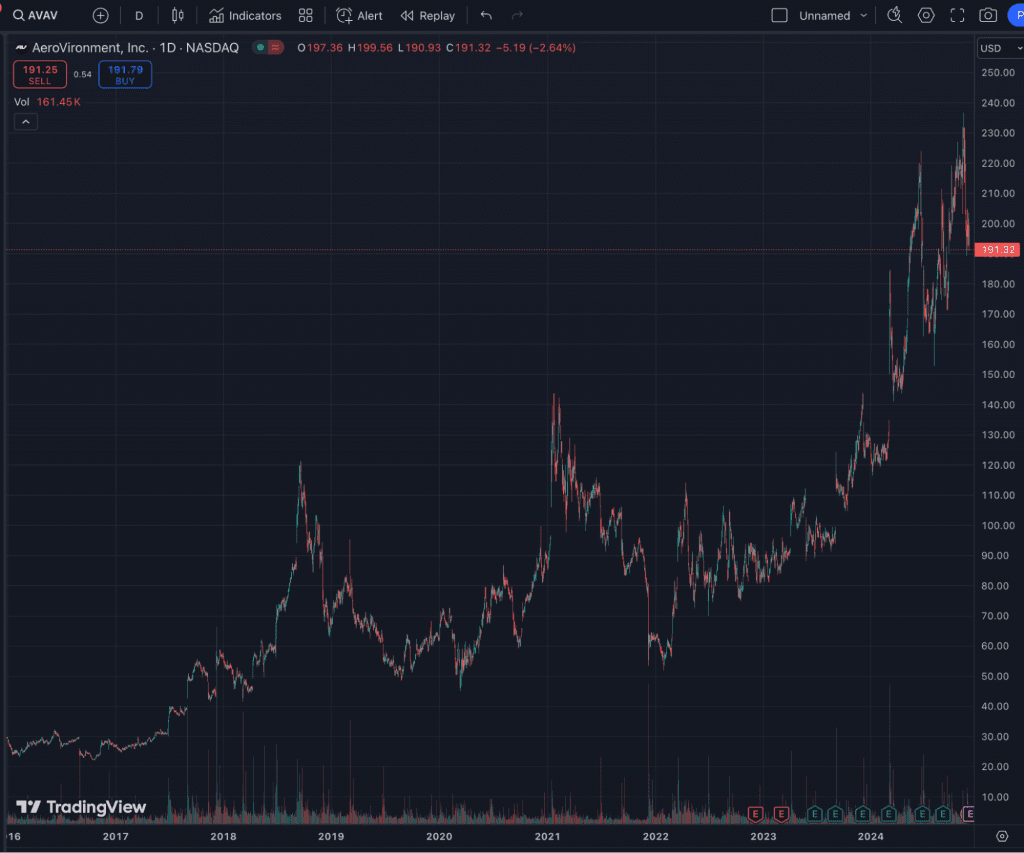

One is AeroVironment (AVAV), which is more of a drone defense play:

Draganfly (DPRO) has been around for a while, but the stock hasn’t done particularly well. The company just went through a reverse stock split, and could be ready for a push higher from here:

The new kid on the block is Unusual Machines, ticker UMAC.

After its IPO, this stock wasn’t doing much of anything… until it recently went parabolic:

As I record this, the stock is in a squeeze and could continue even higher…

But what if you could have been warned ahead of this move?

There were actually three distinct signals you could have followed into this stock before it soared more than 550%...

Original Post Can be Found Here