It’s been over a year since OpenAI released ChatGPT to the world.

The AI floodgates it opened have been revolutionary… but limited in scope. It reminds me of the homebrew computer club in Menlo Park, where Steve Jobs and Steve Wozniak met.

It’s very cool tech – it just hasn’t hit mass adoption yet.

Part of that is due to the lack of competitors in the space. But that’s changing…

Faster than you think.

OpenAI is a walled garden; you can’t tweak the program, and you don’t know what training data they are using.

But just like any technology, the size and costs go down as the tech develops.

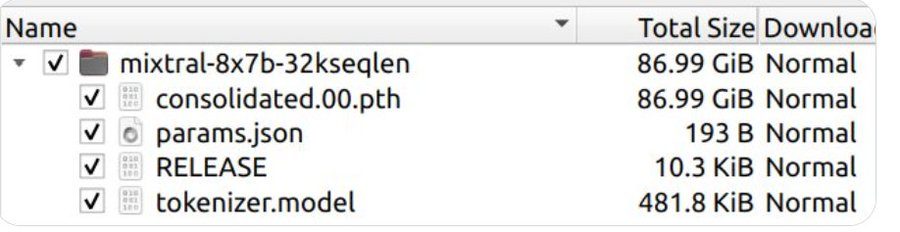

Take a look at this:

2024: The Year of Small AI

This is a screenshot of an open source AI model that’s publicly available to download.

It’s only 86 gigabytes. It takes less than 10 minutes to download, and it’s not nearly as resource intensive as some of the bigger AI models.

Remember in the mid-90s when AOL was the only internet game in town?

You would get a free trial CD at the mall or in your mailbox, and all of your internet activity would take place inside their software.

Then came along Netscape, and it opened up the world to the broader internet…

And unlocked a massive amount of value to the economy and to investors.

As AI breaks out of these walled gardens smaller companies will pop up offering faster solutions.

None of these companies are publicly traded right now…

But the “picks and shovels” are.

There are companies that do well providing the infrastructure needed for these companies.

Nvidia (NVDA) is a great example (it closed 2023 up 250% on the year):

2024: The Year of Small AI

Aside from semiconductors, there’s another industry set to benefit from the AI megatrend…

Server space.

Right now, tech startups are spinning up new AI models in the cloud. That simply means they don’t directly own the servers but instead pay another company to do it for them.

The biggest player in the space is Amazon (AMZN), with their Amazon Web Services (AWS) division.

You can also get space from Microsoft or Google – but there are big risks for new tech companies looking to partner with these established players.

That’s because they’re all direct competitors now. Small startups are putting a lot on the line by hosting their AI technology on Google, Microsoft, or Amazon’s servers.

But this is also where you can find some hidden gems – tech stocks that have been beaten down and are ready to scoop up market share.

Some of these names could see triple digit gains with even a small uptick in growth…

And we’ve just found a solid investing opportunity in a name I’ve known for at least a decade.

What really tipped me off was seeing a company director purchase $50,000 worth of stock in his own account…

And if you can get in around the same price, it could be a quick double by the end of the first quarter.

I recently sat down for an interview to talk more about how I follow corporate insiders to stock opportunities just like this one…

And I also gave the details of three other insider stocks on my radar right now.

You can watch the whole thing for free at this link here.

Original Post Can be Found Here