I grew up in the ‘90s, back when there was a renaissance for magazines.

Zoobooks would come in and you would learn everything about zebras.

Boy’s Life had a mail-order section in the back that your mother would always refuse to buy from.

And then you had Popular Science. This was the futurist magazine that made it easy to understand for me. It’s one of the reasons I went into electrical engineering in college.

It always felt like “The Jetsons” when you opened up the pages.

They would talk about flying cars and space travel and robotics. I felt like Ralphie from “A Christmas Story,” but instead of a Red Ryder BB gun, I’m reading about rockets.

In 2023, after 150 years, Popular Science stopped publishing their physical edition.

It’s now a blog.

There has been a hidden suffocation in future technology. Too many companies have focused on political alignment rather than actually building things.

That’s changing, and quickly. It’s like Industry has been in a Woke Trance for over a decade, but once you snap out of it, you can innovate and accelerate.

Quantum computing has been a “frontier technology” since I was a kid. It sounds like science fiction but it’s having its moment in the sun right now.

Quantum computers allow you to store data at the quantum level. There’s some fancy math behind it, but it allows for faster computational speed.

The tech works great for cryptographic applications – so that means blockchain is now a play.

And it also speeds up machine learning, the building blocks of the AI revolution.

It’s clear that the tech has promise, and that’s why IONQ Inc. (IONQ) has been on a tear.

IONQ is a quantum computer company that has fully integrated with the major cloud services, and they just reported a monster quarter.

Here’s what they reported:

The company hit a quantum leap, and investors are profiting from it:

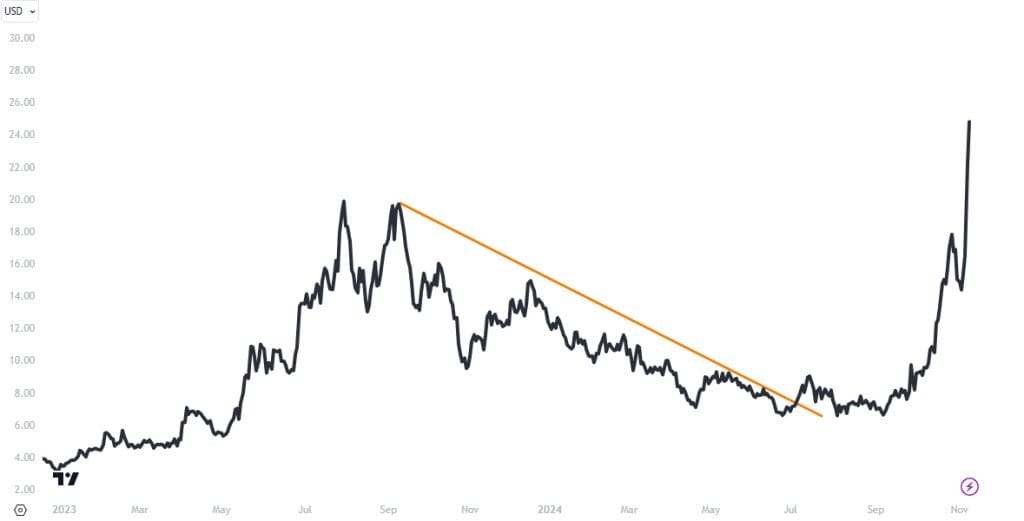

The stock’s September low was at 6.30. The stock is currently trading at 24.79, which is a gain of 293%.

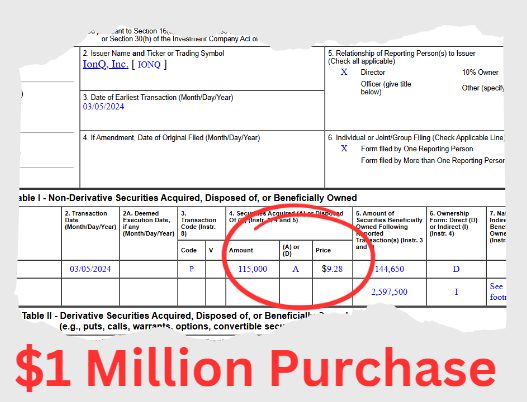

Even though I love the idea of quantum computing, this company wasn’t even on my radar. It was only when a key insider gave us a signal that I thought it would be a good buy:

Once I saw that, I knew the stock was primed for a strong push higher.

When the timing was right, I made the call to buy the stock and pick up the April 2025 $15 call.

That call option has gone from a value of 0.74 when we purchased to 11.00. That’s a gain of 1,386%.

If you had purchased 10 of these contracts, it would have cost just $740. That position is now worth $11,000. Not bad for a trade that transpired over just a few weeks’ time.

Right now I’m watching three other stocks showing similar insider signals – I’ll give you more details about them in a video presentation right here.

Original Post Can be Found Here